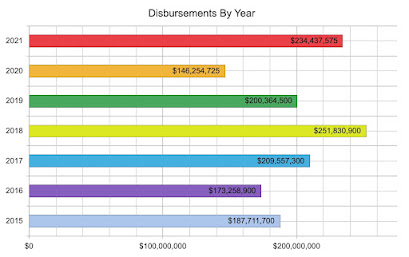

On June 17, the Public Utility Commission posted detailed information about the distribution of 2021 Act 13 Drilling Impact Fee revenue from unconventional shale natural gas producers – totaling $234,437,575 – on the PUC’s Act 13 website.

County and municipal governments directly affected by drilling will receive a total of $123,217,163 for the 2021 reporting year.

Additionally, $86,030,934 will be transferred to the Marcellus Legacy Fund, which provides financial support for environmental, highway, water and sewer projects, rehabilitation of greenways and other projects throughout the state.

Also, $25,189,477 will be distributed to state agencies, as specified by Act 13.

The PUC has forwarded the information to the Department of Treasury for payment and expects checks to be distributed in early July.

Since 2011, the Act 13 Drilling Impact Fee has resulted in total revenues of $2.258 billion.

The Fee is assessed per well, and not on the amount of natural gas produced like a severance tax.

The Independent Fiscal Office calculates an effective tax rate on natural gas drilling companies for the Act 13 Impact Fee every year. For 2021 revenue collections, the tax rate was 1.3 percent, the lowest on record. In 2020, the ETR was 3.3 percent, the highest on record. Read more here.

This year’s distribution is near $100 million higher than last year, driven primarily by the average price of natural gas in 2021 ($3.84 per MMBtu) versus the average price in 2020 ($2.08 per MMBtu) which generated a higher impact fee payment for each well in 2021 – along with the addition of 518 new wells during 2021.

The U.S. Energy Information Administration expects the average price of natural gas in May 2022 was $8.14 per MMBtu and this summer is expected to be $8.81 per MMBtu. Read more here.

The distributions for individual municipalities are detailed on the PUC’s Act 13 website.

Extensive details regarding the impact fee distribution are available online, including specifics on funds collected and distributed for each year since 2011.

Visitors can search and download statistics such as distributions to individual municipalities or counties; allocation and usage of those funds, based on reports submitted by various municipalities; eligible wells per county/municipality; and payments by producers.

The PUC is responsible for implementing the collection and distribution of an unconventional gas well fee (also called an Impact Fee), established by the Unconventional Gas Well Impact Fee Act and signed into law as Act 13 of 2012.

Visit the PUC’s Act 13 website for more information.

Reaction

The Marcellus Shale Coalition released this statement on the Act 13 Impact Fee announcement--

“The nearly 60 percent increase in this year’s distribution is directly related to heightened activity levels and the commodity price environment, underscoring the importance of policies that encourage domestic natural gas development, transportation and use. Our members continue to be focused on responsibly developing clean, abundant Pennsylvania natural gas, which is even more important today in keeping America and our allies energy secure," said Marcellus Shale Coalition president David Callahan

Click Here for the complete statement.

NewsClips:

-- WSJ: High U.S. Gasoline, Diesel, Natural Gas Exports Contributing To Spike In U.S. Prices

“A rapid rise in American fuel exports this year has helped push gasoline prices to a record $5 a gallon and is pressuring U.S. prices of natural gas, which hit the highest levels in over a decade earlier this month.”

-- Inquirer - Andrew Maykuth: A Proposed LNG Natural Gas Plan In Chester Would Be Gigantic And Hardly Anyone Knows About It

-- Scranton Times Editorial: Process LNG Natural Gas Where It’s Shipped Not Where It’s Taken Out Of The Ground

-- Beaver County Times: Big Sewickley Creek Plan Pits Drilling Company Against Watershed Defenders

-- PennLive: Natural Gas Royalty Payments On The Rise In Shale Gas Regions Of PA

-- The Guardian: Fossil Fuel Firms ‘Have Humanity By The Throat,’ Says UN Head In Blistering Attack

-- Reuters: UN Chief Says The Dash For New Fossil Fuels Is ‘Delusional’

Related Articles This Week:

-- Who’s Protecting Taxpayers? House To Take Up Bill Exempting Conventional Oil & Gas Wells From Plugging Bonds Sticking Taxpayers With $5.1 Billion In Cleanup Liability

-- Oil & Natural Gas Facility Health Impacts Assessment Bill Introduced In The House

-- Penn State Beaver Seeking Volunteers For June 23 Focus Group On Energy Development, Groundwater Quality & Public Health In Western PA

-- EQB Adopts Part I Of Final Regulation Reducing Oil & Gas VOC/Methane Emissions; DEP Documents 80% Of Methane Emissions Come From Conventional Oil & Gas Facilities

-- Post-Gazette Editorial: Republican Lawmakers Poised To Cost PA Billions In Highway Funding At Behest Of Oil & Gas Industry

[Posted: June 17, 2022] PA Environment Digest

No comments:

Post a Comment